You must first be authorised in Corppass for any of IRAS digital services eg. The GST amount shown in Field 42 must not be included in the amount shown in this field.

Untitled Fumigation Services Tenders Bid

GST-registered businesses are required to charge and account for GST at 7 on all sales of goods and services in Singapore unless the sale can be zero-rated or exempted under the GST law.

. Abstract submission deadline. Last updated on 03 November 2021. - 5 If the proper officer fails to take any action - a within a period of seven working days from the date of submission of the.

RFD-01 must be filed for the following types of GST refund claims. The GST Council of India has approved the introduction of E-invoicing or electronic invoicing in a phased manner for. PLEASE REFER ADVISORY 162022 DATED 030822 REGARDING ACCOUNTING HEAD CODE TO BE USED FOR PETROLEUM CRUDE AND AVIATION TURBINE FUEL FOR PAYMENT OF SAED Functionalities for appeal proceedings for Taxpayer appeal APL-01 and Tax Department.

Must be completed on the last page of all Forms B2 when requesting a refund or when requesting a complete reversal of a CBSA decision which has been secured not paid. A taxable person under GST. Here in this article we will talk about issuance of Deficiency memo issued by the department after preliminary verification of the refund claim filed.

Rule 903-Where any deficiencies are noticed the proper officer shall communicate the deficiencies to the applicant. The ICEGATE system will share payment information with the GST portal once the refund payment has been credited to the taxpayers accounts. 102022 Central Tax has been issued to notify that the registered person whose ag.

20 th August 2022. Dear Mam I have issued some credit notes dated 31032020 and reported in quarterly GSTR 1 of July -September ie on 11th October and pay tax under GSTR 3B accordingly on 20th of October but now i found I mistakenly left 1 more credit note dated 31032020 to report in same October gstr 1 for the Quarter May to Sep whether could i. Cfor sub-rule 5 the following sub-rule shall be substituted namely.

Learn all About the Types of Taxable Persons and Provisions for Each Under the GST Law. 2022 - 032931 PM. Do they just act as a last mile interface or do they also bring in their transports into SAP and we leverage their cockpit to send out the payload.

Goods and Services Tax - A flurry of notifications has been issued on 05072022 by the CBIC to give effect to some of the recommendations of the 47th GST Council Meeting held in Chandigarh on 29th 30th June 2022. Summary of the same is hereunder. The above fee is inclusive of 18 GST.

Taxpayers can get extended time up to 30th September 2021 to revoke cancelled GST registration if the last date for the same falls between 1st March 2020 and 31st August 2021. View Tenders by. An archive of the Government Tenders floated in the recent past whose Last Date for application has expired.

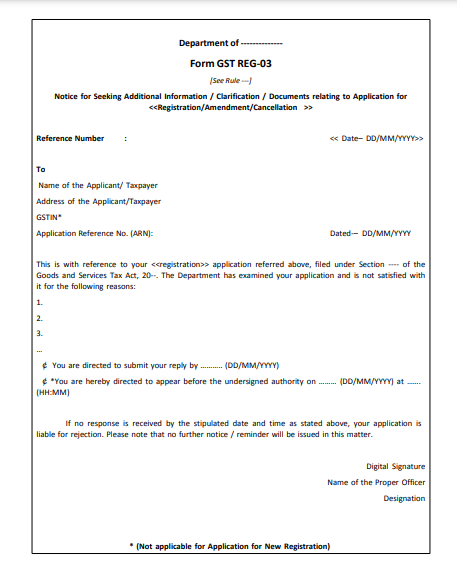

The notice in FORM GST REG-03 may be issued not later than thirty days from the date of submission of the application. 09 July 2019 The Hindustan Times-BSNL to provide pre-loaded SIM to Amarnath yatris02 July 2019 The Business Line- With new services BSNL to take on Whatsapp other OTT players. Contents owned and maintained by.

KIND ATTENTION OF CENTRAL EXCISE PETROLEUM SECTOR TAXPAYERS. Remedy available with the applicant after the issuance of memo etc. Pharmacy Education has undergone a paradigm shift in the last two decades.

E-Filing of Corporate Tax e-Submission of Employment Income etc by the business to access the GST registration digital service on mytaxirasgovsg. PLEASE REFER ADVISORY 162022 DATED 030822 REGARDING ACCOUNTING HEAD CODE TO BE USED FOR PETROLEUM CRUDE AND AVIATION TURBINE FUEL FOR PAYMENT OF SAED Notification issued to notify the provisions of clause c of section 110. Auto submission of e-Invoices to IRN.

Standard registration INR 3540. If none of your employees or third parties eg. The GST portal will share the information with the taxpayers by SMS and e-mail.

Must be completed on the last page of all Form B2. KIND ATTENTION OF CENTRAL EXCISE PETROLEUM SECTOR TAXPAYERS. Your tax agent has a Corppass account please refer to our webpage on.

The tenders issued by various Government Departments Organisations for which the submission date is still open. Steps to apply in form RFD-01 for most types of GST refund.

Gst Payment Dates 2022 Gst Hst Credit Guide Filing Taxes

Here Are The Simple Steps For Gstregistration Https Gst Registrationwala Com Gst Registration Bar Chart Chart Pie Chart

Obtaining New Access Code To Netfile Gst Hst Return Filing Taxes

Obtaining New Access Code To Netfile Gst Hst Return Filing Taxes

How To Reply To Gst Reg 03 Form User Manuals

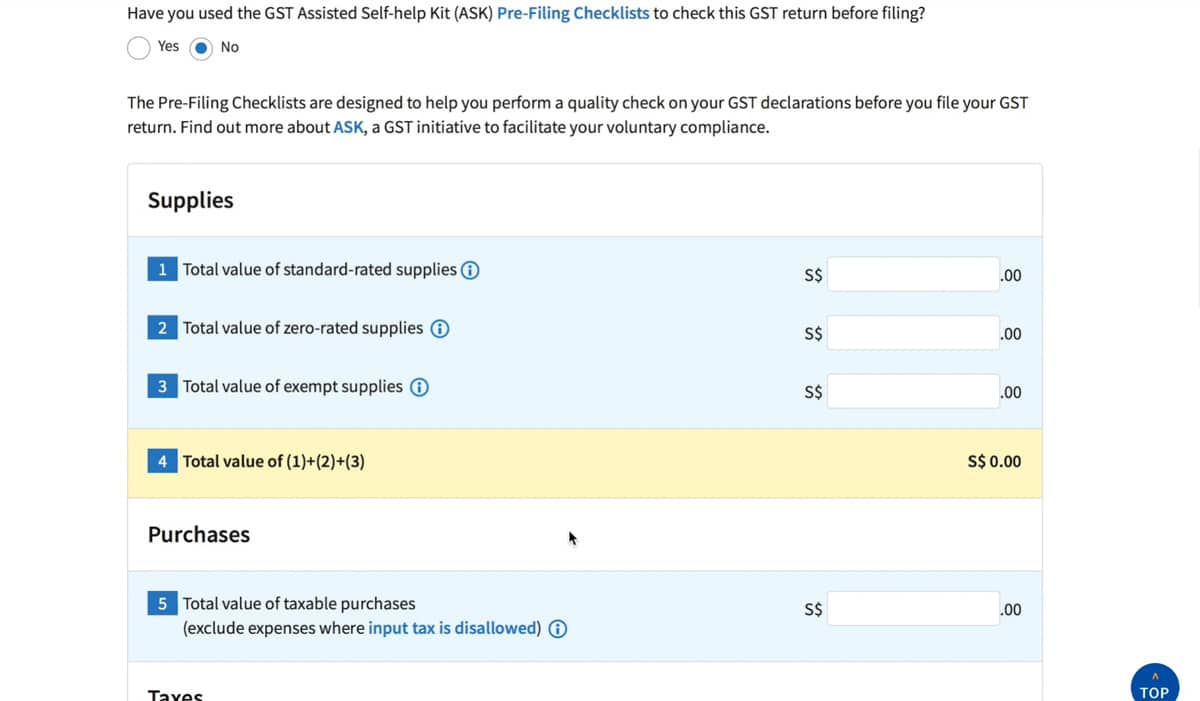

Gst E Submission F7 Correction Error On Gst Submission Knowledge Base Financio

Epf Form 15g Download Sample Filled Form 15g For Pf Withdrawal Gst Guntur Tax Deducted At Source Taxact Employee Services

Realtimme Cloud Solutions Helpfile

Gst Filing Process How To E File Your Gst Return In Gst F5 Sg Small Business Center

A Basic Guide To Gst F5 Form Submission To Iras Paul Wan Co

Due Dates Of Gst Payment With Penalty Charges On Late Payment

Appointment Of Ca Firms With Pspcl For Ind As Implementation Http Taxguru In Finance Appointment Of Ca Firms With Pspcl Finance Corporate Law Appointments

Gst E Submission F7 Correction Error On Gst Submission Knowledge Base Financio

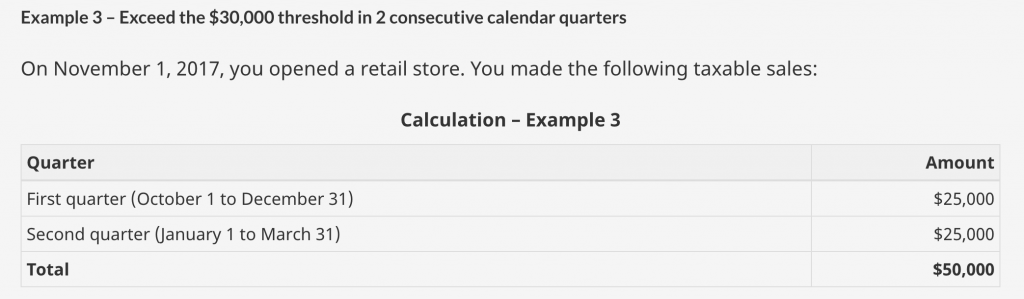

Sales Tax In Canada Hst Gst Pst When You Re Self Employed

Due Dates For Tds Income Tax Return Itr Income Tax Return Tax Return Income Tax

Notice Of Assessment Reassessment Everything To Know Kalfa Law

Become Travel Agent Or Start A Travel Agency In India Travel Expert Travel Agency Travel Agent Become A Travel Agent

Gst Compliance Calender Encomply Billing Software Data Analytics Compliance

Gst Hst Quarterly Instalment Payment Dates For Businesses In 2022 Savvynewcanadians